The new rules require that all leases of more than 12 months must be shown on the business balance sheet as both assets and liabilities. That’s why operating leases of less than a year are treated as expenses, while longer-term leases are treated like buying an asset. Leasing vehicles and equipment for business use is a common alternative to buying.

A company must also depreciate the leased asset that factors in its salvage value and useful life. When the leased asset is disposed of, the fixed asset is credited and the accumulated depreciation account is debited for the remaining balances. Capital leases are considered the same as a purchase for tax and accounting purposes. Operating leases cover the use of the vehicle, equipment, or other assets, making payments during the lease term.

Impact of Capital Lease and Operating Lease on Financial Statements

You also classify payments as operating activities in the cash flows statement. The key accounting difference between the two is that you record an operating lease as an expense, whereas with a finance lease, you record the object of the lease as an asset, which is subject to depreciation. A lease is considered a finance lease if the lease term makes up the major part of the asset’s economic life. You might be confused about the differences between a capital lease vs. an operating lease. Or maybe you already have a lease and you are confused about how to record it in your accounting.

The lessee is paying for the use of an asset which spends the majority of its useful life serving the operations of the lessee’s business. Under generally accepted accounting principles (GAAP), the major form of lease is the finance lease, also called the capital lease. When it comes to differentiating between capital lease vs operating lease, IFRS does not recognize this classification. Both types are treated as a finance lease, and the lessees are entitled to record them on the balance sheet. Whether you’re making operating lease payments or capital lease payments, you’re making big investments in your business.

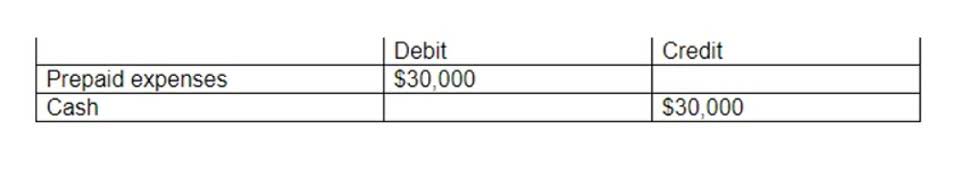

What are Prepaid Lease Agreements? Definition, Requirement, Advantages, Disadvantages

If there’s also no option to purchase the leased item at the end of the lease term, then it is an operating lease. Similarly, if the value of your lease payments is equal to less than 90 percent of the item’s fair market value, then the arrangement is an operating lease. And if your lease terms are shorter than 75 percent of the item’s estimated useful life, then you have an operating lease. Treating the lease payments as expenses and deducting them from income might reduce your tax liability dramatically.

Heavy ticket assets such as aircraft, ships, diesel engines, and expensive commercial locations are available for purchase under capital lease. All these assets make fine examples of capital leases because companies are purchasing them on lease all the time. With the fundamentals of a capital lease versus operating lease laid out, you can now figure out which lease arrangement works best for you.

Capital Lease vs. Operating Lease: Which Option Is Best?

For example, if a company determines it has immaterial copier leases, it must aggregate all its copier leases and analyze the total amount of copier leases for materiality to stakeholders . Leases with a total term, including renewal options reasonably certain to be exercised, of 12 months or less are exempt from capitalization. Note that under ASC 842 this measurement is taken from lease commencement to lease end, not your transition date to lease end.

- Operating leases are off the balance sheet, but there are increasing standards to make this on the balance sheet item.

- If you are a lessor instead of a lessee—meaning you are in the business of leasing assets to others—then how you handle your accounting for leased equipment is mostly unchanged by the 2016 Accounting Standards Update.

- A capital lease is capitalized on the balance sheet by the present value of future lease payments.

- Moreover, there’s a possibility that BNL’s exceptional operating metrics will deteriorate over time.

- For accounting purposes, operating leases aren’t shown on the business balance sheet, but the lease payments are included on the business profit and loss statement.

The decision shapes how a business utilizes assets, directly impacting its cash flow, tax deductions, and overall flexibility. Leasing has become a popular option for businesses to acquire assets without the full upfront cost, providing flexibility and financial advantages. A capital lease is a non-cancellable contract, and therefore, all the terms and conditions, and rules should be followed strictly by both parties. The lessee defaults on lease/rent payments frequently, forcing the lessor to terminate the lease contract before the expiration of the lease term. Operating leases are off the balance sheet, but there are increasing standards to make this on the balance sheet item. In general, businesses lease vehicles and equipment to fund their business without having to finance a purchase of equipment.